V-shaped, w-shaped, or u-shaped. Economists, politicians and any number of experts disagree on just how the recovery will take shape following the economic crisis brought on by Covid-19. For now, the only thing that unites all is the brutal impact it is already having on business activity.

After two months of lockdown, we are gradually returning towards normal life. The limitations imposed in order to contain new outbreaks and the fears many people still have are having a devastating effect on consumption levels. This is being reflected in increased savings, now back at 2013 levels according National Statistics Institute (INE) figures.

BUSINESS RESTRUCTURING: THE ROAD TO SURVIVAL

This complicated situation is especially prevalent in sectors such as tourism, retail and industries dependent on consumer goods, with a corresponding risk to the future viability of many companies. It is a situation that is already calling for drastic but necessary decisions in order to ensure survival and minimize risks.

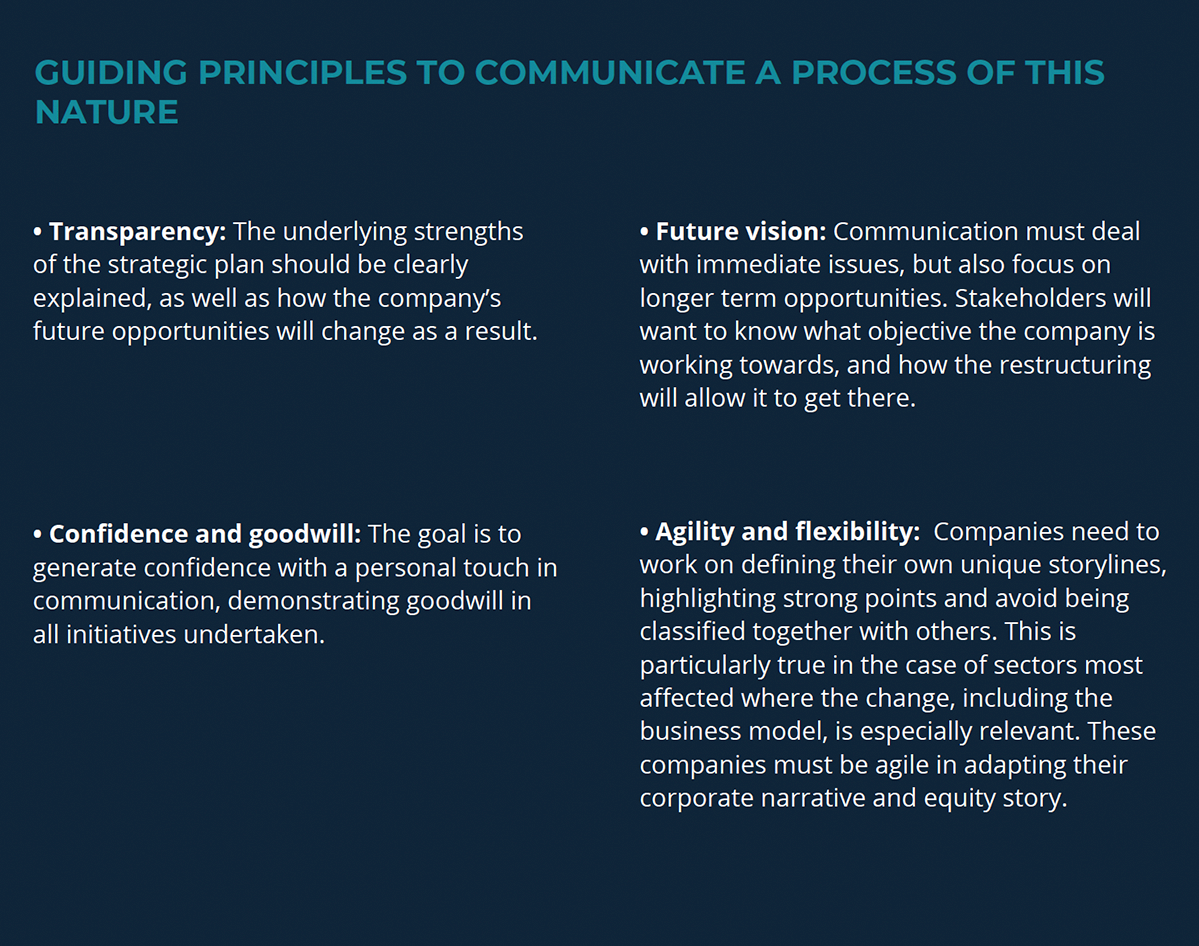

It appears that business restructuring is becoming an inevitable option for many organizations. The environment has changed radically and it is necessary to adapt structures to the new reality at each moment in time. The process is more intense or lasting according to the degree of impact, and its success will depend on the support of stakeholder groups. It will be important to identify the different phases and priorities in each of them, deploying communication as a basic tool to win stakeholder buy-in.

Phase1: labour adjustments

This is the first measure companies took to deal with the drop in activity following announcement of the state of alarm. For the vast majority, the decision was to impose temporary layoff plans (ERTE) for their employees, which for the moment are in effect until September.

It will be from then that many organizations will have to evaluate whether they can absorb the same salary costs prior to the health emergency. In the event the answer is negative, possible alternatives include temporary solutions that give companies additional time such as temporary layoff plans for production and/or economic reasons, or a permanent workforce cut justified by loss of contracts and clients.

How should communication strategy be focused?

In this phase, the goal should be to facilitate agreement between worker representatives and the company in order to minimize the impact for both. In this respect, it is important to take the initiative and explain transparently the situation faced by the company, sharing the reasons that justify the inevitability of the decision and all the measures related to ensuring the survival of the company. This is incompatible with short and medium term decisions that seek only to preserve business profit. Care should therefore be taken to avoid positive financial announcements before establishing a solid relationship with employees.

It is also important to take into account that the fact that while the general situation predisposes towards accepting layoffs or collective dismissals as unavoidable, this does not necessarily mean an absence of conflict. So in taking drastic measures with a wide social impact, we need to anticipate possible scenarios that affect communication management and be prepared for each of them.

“The goal should be to facilitate agreement between worker representatives and the company in order to minimize the impact for both. In this respect, it is important to take the initiative and explain transparently the situation faced by the company”

Phase 2: short and medium term cash management

This normally takes place over time with labour adjustments, with the sole objective of gaining time in order to seek structural solutions that guarantee future viability. The initial steps tend to be to request a moratorium on fiscal obligations, such as delaying VAT payments, extending staggered payments of company tax, extending income tax deductions without charge, and delayed Social Security contributions. All this accompanied by a renegotiation of contracts with suppliers and leaseholders.

Once the financial situation has been brought under control, the priority is to obtain government support to cover liquidity requirements on more favourable terms than from conventional credit markets. In Spain, this is currently being channeled through the Official Credit Institute (ICO), to which European funds are expected to add support in the coming weeks.

As these channels are insufficient on their own, alternative sources of liquidity must be sought. Among those emerging with special force is so-called direct lending, bridge loans at high interest rates that give breathing space until a restructuring of medium and long-term debt. This alternative is normally facilitated by in international funds specializing in debt operations.

How should communication strategy be focused?

The main objective should be to avoid reputational impact that creates doubt over the long-term viability of the business. To be avoided at all costs is an idea taking root that the company is on its last legs. This requires anticipating noise generated by third parties with opposing interests (controlled pro-activity) maintaining a highly transparent relationship with the market to avoid any sense of urgency provoked by a lack of information in the case of listed companies, and seek allies who can reinforce confidence in the business model, such as credit rating insurers.

Phase 3: redimensioning the business, through three workstreams

3.1. Operational restructuring/business sustainability:

Once the process of lockdown easing and reactivating business activity has been completed, companies will need to evaluate the impact of Covid-19 on their recurring activities. As a result, many will arrive at the conclusion that their business won’t regain pre-crisis levels and that they must adapt their structure. As a result, a transition from temporary to permanent layoffs is likely, leading to staff cuts, the closure of business lines and partial divestments.

How should communication strategy be focused?

The priority should be to ensure that workforce adjustments and partial reductions in business activity do not affect the rest of the company. For this, it is essential to establish a direct communication channel with key clients and suppliers, ensuring business continuity. Only in this way can the company guarantee supplies and cash flow, a process that will need to be carried out in parallel with payroll cuts and divestments.

3.2. Financial restructuring

Increased corporate debt levels during the lockdown and reduced productive capacity brought about by falling demand, with the corresponding impact on cash flow generation and Ebitda, will leave many companies unable to service their financial commitments. Banks are likely to work on delaying these obligations until the fourth quarter in the face of insufficient funds to meet obligations.

How should communication strategy be focused?

The overriding objective is to ensure a financial structure that is sustainable in the medium and long term, to be worked through in a demanding negotiation process with banks. Communication therefore needs to be a tool that assists in creating a climate of opinion that is favourable to the company’s interests, supporting its position in open conversations. It will be essential to convey a perception that the business is viable and therefore increase pressure on decision-makers.

3.3. Distress processes – M&A

Companies that have no access to additional bank support will need to look for more demanding and expensive alternatives such as the secondary market (through capital increases or debt issues) and private capital (entering share capital or acquiring debt). These last-mentioned are likely to emerge at the end of the year with activity of private equity firms and funds specializing in determined sectors, which could impose strict divestment plans.

How should communication strategy be focused?

As with experience in financial restructurings, it will be essential to generate a climate of favourable opinion that contributes towards the success of these transactions. A key element will be to have a narrative that makes clear that the transaction is the only option available to save the business and jobs, insisting on a sense of urgency and inevitability.

Fase 4: Pre-receivership and insolvency

This is the last option for companies that have failed to complete a financial restructuring or attract investor interest, and hope to avoid a winding up of the business. A voluntary declaration of pre-receivership, before a creditor forces the issue, will help existing shareholders to control the process.

How should communication strategy be focused?

In order to manage the process, existing shareholders will have to work towards a unified message regarding the viability of the company and future plans . Third party allies such as communication media, institutions and unions, will need to be identified and activated in order to increase pressure on decision-makers (judicial authorities).

KEY ASPECTS TO KEEP IN MIND WHEN DEFINING STRATEGY

Context and importance of the political environment: Compared to previous periods of restructuring, we are likely to see a greater degree of political involvement, in view of the magnitude of the crisis. Companies benefitting from exceptional measures, such as ICO credits will face greater scrutiny of their actions towards employees and executive pay, among other aspects.

Aligning with stakeholders: it is important to convey the right message to each involved stakeholder, and therefore crucial to stay abreast of their perceptions in order to define a strategy that ensures they receive the appropriate signals.

Key role of the media: Specialist journalists and opinion writers can be highly influential, as they feed off a large variety of sources close to the process. These journalists are normally quick, well informed, financially savvy and familiar with the technical aspects. An open and trusting dialogue with them is essential.

Leaks and rumours: This is a highly sensitive process and leaks to the media are possible due to the large number of advisors involved (banks, lawyers, etc), as well as competitors or suppliers, helped also by reduced levels of confidentiality. Private information often leaks and we need to be prepared to act in each situation.

Different senstivities and cultures: Among the effects of globalization is the international spread of business activities. Despite this, broad cultural differences, which can impact on a negotiation, are often ignored. A company based in one country can often have a principal shareholder in another, and most bondholders from yet another. Evidently, a multinational company operates in many countries, and most of these are now establishing legal frameworks to protect vulnerable companies. Cross-border legal battles in various languages can clearly become one of the major upcoming communication challenges

“Private information often leaks and we need to be prepared to act in each situation”

Authors

Luis Guerricagoitia

Vicente Estrada