INTRODUCTION

Today’s society is experiencing a major economic and social impact due to the global health crisis. Any company hoping to recover in such an unstable industry environment must consider its relationships with key stakeholders, as well as how it manages its capital on a day-to-day basis. Companies will find their market position much easier to maintain and improve, with more adaptability for the future, if they emphasize their consumers, clients, employees, suppliers, shareholders and other community members, aligning their interests with those of their stakeholders to create connections.

This century is seeing its second turbulent decade. In this Volatile, Uncertain, Complex and Ambiguous (VUCA) ecosystem the most successful companies not only understand their industry environments, but also have the skills to respond appropriately. Most often, this awareness and action manifests as a culture of collaboration, continuous improvement and constant transformation.

Successful companies also clearly lay out their organizational purpose, both internally and externally. They are able to articulate why, how and for whom they exist, and they never act without explicitly stating what they wish to obtain or accomplish.

At first glance, this may seem a straightforward task, but anyone leading an organization knows how much more complex it can be in practice. And today, this task is more difficult than ever, though still not impossible. A change in perspective is key: Companies must focus more on relational capital, without entirely overlooking economic capital either. We must move beyond the supremacy of the shareholder to a new, more balanced framework, incorporating the interests of all our stakeholder communities.

From the Business Roundtable to the World Economic Forum, there is widespread consensus that stakeholder capitalism is here to stay. So how did we get here, and how do we make the most of it?

(UN)LEARNING CAPITAL MANAGEMENT

At the turn of the century, a business management theory revolving around creating value shared with stakeholders surged. With this trend came an upswing in corporations emphasizing ethics and community relations in their management and positioning.

To understand what this shift entailed, we must examine the challenges that boards of directors and chief executives faced. These administrators have the most direct responsibility for creating value for stakeholders, but in order to succeed on that front, must also be aware of the range of values, many of which are contingent on varying community interests.

In many communities, accountability is becoming increasingly important and demanded, to the vexation of many financial departments. As company goals expand to include the interests of wider demographics, there is exponentially more need to grow both tangible and intangible value.

Traditional reports are no longer sufficient for demonstrating value creation. When the European Non-financial Reporting Directive was put into place, few understood its origins or implications. These regulations seek to adapt to and incorporate today’s newer issues, requiring companies to comply with and report on non-financial aspects of their business. Conversely, companies failing to comply will be held accountable.

If we wish to respond to these changes well, we must unlearn what we know – one of the greatest challenges for companies and individuals alike. We must unlearn the shareholder-centric dynamic of reports and management. From now on, these must also consider what value has been created for consumers, clients, employees, suppliers, citizens and all other stakeholders as well.

Likewise, companies must unlearn their single-minded focus on economic and financial capital. Company balance sheets are including more and more space for intangibles, and management dashboards are leaving growing room for non-economic tangibles.

“We must unlearn the shareholder-centric dynamic of reports and management. From now on, these must also consider what value has been created for consumers, clients, employees, suppliers, citizens and all other stakeholders as well ”

All companies necessarily secure resources via their internal ecosystems so that they can operate, with the obvious necessity of incorporating economic capital. This process is what generates the assets a company requires to function, as well as the working capital needed to propel its workflow. Corporations have become the undisputed masters of financial assets, to the extent that much of society assumes organizations care only for this form of capital, to the detriment of all else. Our goal is to debunk that perception.

A secondary asset required for organizational action is talent capital, the human capital that enables a company’s most basic of functionality. This means turning to the employment market in an attempt to attract talented individuals aligned with company interests and operations – in a sense “leasing” a substantial part of their time so they can aid in fulfilling the organization’s purpose and development.Naturally, there is an economic aspect to be managed regarding who a company employs (coming in the form of income statements), but beyond that, another concealed asset must be managed: Talent. Can companies be held accountable to stakeholders for talent management? This is a question that boards of directors should be asking company chief executives. Policies devoted to talent management help with value creation in places where personnel policies focused on labor cost management cannot. Focusing on the development of employees themselves, as people, will entail much unlearning with regard to internal talent perception, but this step is vital nonetheless.

A third key asset, closely related to but distinct from talent, is knowledge capital. If a board or CEO is to adequately respond to current events and remain competitive, cutting-edge and sustainable, they must be acutely aware of what they do and do not know. This operational line of thinking lends particular importance to management systems as a whole, as well as systems of continuous improvement, research, development and innovation.

Another asset steadily growing in importance is relational capital. Do organizations fully understand their key client, employee, supplier, citizen and shareholder demographics? Do they have management systems devoted to community relations, giving companies the ability to evaluate annual progress on this front? Are businesses aware of what profits they have gained from community relations, and what profits they have lost to mismanagement of this department? Any company can simply survive by meeting the bare minimum of its community’s needs, but any business aiming to remain sustainable well into the future should dedicate both time and money to understanding the megatrends that create constant change. Moving forward, prompt responses to new challenges through updated value propositions and sets of goals will be pivotal.

Proper management of reputational capital is crucial for maintaining positive stakeholder relations. Their internal perceptions drive their attitudes toward companies, heavily influencing their reactions to company messaging, as well as the likelihood they will buy a business’ products, services or shares. A positive relationship is what will cause stakeholders to work with a given company, offer it finances, give it license to operate or even deliver their products or services to it for inclusion in its value chain. Reputation creates value, and thus must be managed as a key intangible.

Any enterprise can claim to be worth more by taking the sum total of both its tangible and intangible assets, but such an evaluation is insufficient. Boards of directors are beginning to take responsibility for fulfilling stakeholder interests and maintaining community connections. The primary challenge is to smoothly transition away from a singular focus on economic capital and shareholders toward a holistic view of all stakeholders and their many forms of key capital.

STRATEGIC STAKEHOLDER MANAGEMENT

In recent years, companies have been forced to interact more closely with the environments in which they operate. While the topic of corporate responsibility and the subsequent need for consumer dialogue and engagement have seen a major surge, the reality is that businesses have been aware of these concepts for many years, and most recognize on some level that all stakeholders impact their bottom lines in one way or another.

In 1983, analyses of various stakeholder relations occurred through a strategic lens, positioning consumer communities as essential to company strategy. Mathematician, philosopher and academic Director of the Business Roundtable and the Institute for Corporate Ethics at the Darden School (University of Virginia) R. Edward Freeman is commonly considered to be the father of this viewpoint, and stakeholder theory overall. His article, titled Strategic Management: A Stakeholder Approach was the first piece of literature to assign strategic value to these relationships, effectively extending corporate focus beyond the limits of owners and shareholders. Freeman codified the inclusion of all groups with potential to impact a company on that company’s strategic decision making.

Both company and market crises frequently find their origins in managerial malpractice or incompetence. This preponderance has, in turn, forced both governments and companies to establish ethical and regulatory frameworks for business practices, with the aim of generating more consistent and reliable levels of stakeholder trust.

In today’s era of information, misinformation and information overload, any individual stakeholder has outsized potential to impact any given company. Recent years have also seen the emergence of a “multiple personality paradigm” as the line dividing consumers and employees, citizens and investors, grows thinner and thinner. Hence the growing importance of communication mechanisms that engage all a company’s stakeholders and the need to maintain a consistent narrative across all messages and conversations.

“Incorporating stakeholder management into strategic planning and monitoring systems enables boards to track key assets much more easily, giving the company a distinct competitive edge ”

Conversations with stakeholders must provide information regarding the company’s performance, what should be expected and what operational, financial or reputational risks are present. For the greatest chances of success, this arrangement must then be part of a larger strategic plan that allows the company to approach stakeholder communities from any angle.

For this reason, stakeholder infrastructure, dialogue and prioritization must be a core aspect of the strategic plan itself. If a company is to address the need for ethical, efficient and profitable management that adheres to strict regulatory compliance, then senior leadership must inevitably become involved. Thus, when management committees draw up a strategic plan, it falls to the boards of directors to assess and approve them. The board thus bears the ultimate responsibility for the existence of any channels or tools required to keep their business’ corporate accountability within the stated benchmarks. To allow them to properly evaluate decisions, their committees must also oversee the evolution of company risks, ethical management standards and transparent accountability in the long run.

Incorporating stakeholder management into strategic planning and monitoring systems enables boards to track key assets much more easily, giving the company a distinct competitive edge. This arrangement provides opportunities for anticipation of both future market changes to be taken advantage of and potential crises to be managed. In short, an innovative, integrated, responsible and forward-thinking leadership model is itself an indispensable asset.

STAKEHOLDER MANAGEMENT IN SIX STEPS

1. 360º DIAGNOSIS

LLYC has developed a generalized stakeholder management method, designed to be accessible to companies in any business sector. The first step toward enacting it, however, is a 360° diagnosis of the company, one that reviews not only the business’ communication flow and channels, but also how the organization functions as a whole. This diagnosis takes various industry contexts and corporate organizational structures into account (SMEs, family firms, big business, etc.), as well as the regulatory management frameworks in which they exist, all without losing sight of the company’s core business. A sound analysis never disregards important basics, such as the company’s purpose and values, nor does it neglect fundamental aspects of management, such as ethics, risk awareness or regulatory implementation. All these factors shape stakeholder relationships in their own ways.

Both this phase and the next demand the full engagement of not only senior management, but also each of the company’s departments.

A sound analysis never disregards important basics, such as the company’s purpose and values, nor does it neglect fundamental aspects of management, such as ethics, risk awareness or regulatory implementation”

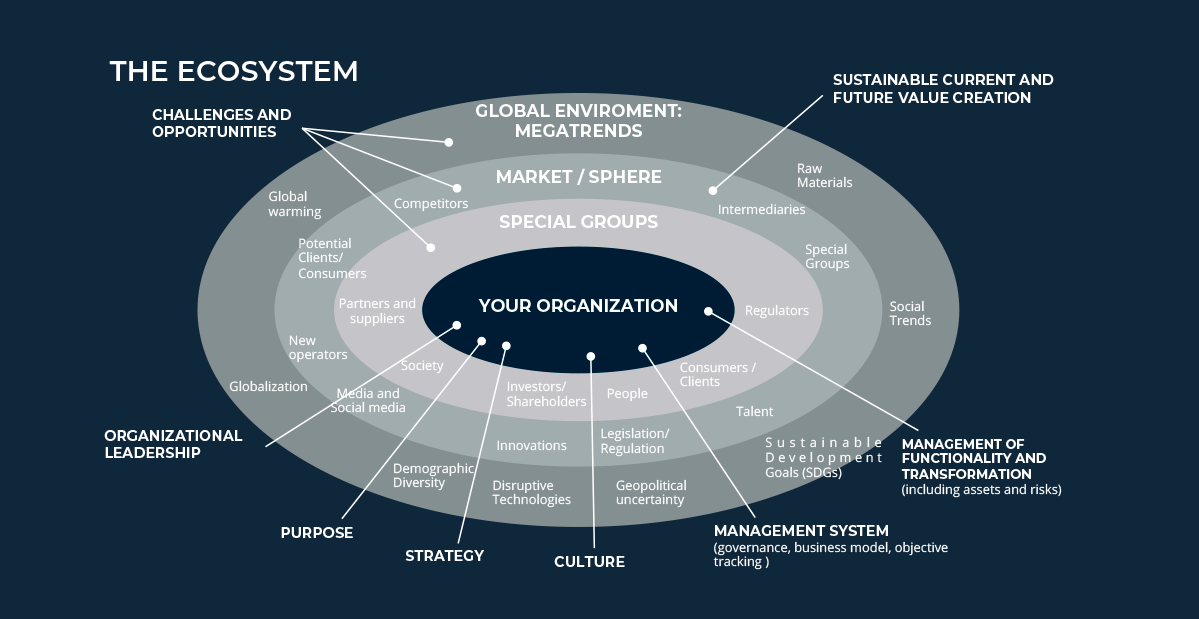

2. AN ECOSYSTEM OF SEGMENTATION AND PRIORITIZATION

A thorough analysis tells us where a company stands, but that knowledge is meaningless until we act on it. The next step is categorizing and prioritizing all stakeholder groups, never forgetting the shape of the company’s ecosystem as a whole. This process should take into account the influence each stakeholder has on value creation for the organizational balance sheet. Their influence is most often dictated by their capacity to impact not only the business’ bottom line, but also the day-to-day lives of other members of their community. By this metric, it is plain to see that certain stakeholder groups, such as shareholders and clients, most obviously come out on top.It is not news to state that the decisions and opinions of these groups greatly affect company functioning. However, we must not restrict ourselves to the easiest and most obvious. Depending on a given company’s operations and profile, there may be an entire ecosystem around those stakeholders themselves, one that may significantly affect their behavior. A company should strive to present itself as being firmly rooted in the society in which it operates, with an emphasis on cooperating and engaging with the social groups that will have an inevitable impact on its activities.

With this in mind, other demographics should also be considered, notably including those with no capacity to generate assets or other direct value for the company, but who do have the ability to influence other stakeholders with that capacity. This category might include the media, activist groups or, in highly regulated sectors, public authorities themselves. Individual cases vary widely. There have been instances where an ecosystem analysis has prompted influencers to be classified as stakeholders due to the management demand they required of the company.

The snapshot prioritization of these groups is not static. A company’s situation may change, as may the power and influence of each of its stakeholders. One clear example of this is a family firm that is then floated on the stock exchange with a high level of liquidity. This could modify not only the snapshot of its stakeholders, but would also inevitably and unquestionably alter its ecosystem.In addition to this, existing global trends or megatrends continue to hang over companies’ heads, marking the paths they will inevitably be forced to follow. Monitoring and studying these will allow company management to adapt and react deftly, freeing up enough resources for stakeholder management on a smaller scale.

ECOSYSTEM (BASED ON THE EFQM MODEL)

3. DESIGNING THE RELATIONSHIP MODEL

The organization’s relationship model must be addressed from the top down, as it will directly affect all dialogue between company departments through this process.

The model must always align with the business’ purpose, vision, values, strategy and plan. In addition, it is vitally important that any company fulfill all the principles laid out in its code of ethics. All these elements must coexist seamlessly.

In order to ensure fluid relationships with multiple stakeholder groups, there must be a connection based on transparency and mutual trust. Transparency creates a feeling of security, a vital element when the reality of any company’s daily operations involves many overlapping interests, usually differing in stakeholder perception. Likewise, trust is a fundamental tool for a company aiming to smoothly pursue all its interests evenly. Maintaining that balance will greatly facilitate the fulfillment of strategic goals.

4. COMMUNICATION TOOLS AS VECTORS FOR RELATIONSHIPS

As discussed earlier, stakeholders hold significant power to influence organizations, so relationships with them must be carefully managed and prioritized. Once stakeholders have been identified and prioritized and a fundamental relationship model has been defined, the next step is to address the level of closeness appropriate for a given relationship. This exercise serves to define the various channels and tools a company will use for this purpose. From the initial analysis, we will already have a solid understanding of the potential available channels and tools , so the goal for this phase is to determine which channels will be the most useful and appropriate for each stakeholder demographic. The more consistent and standardized the use of each channel (and the clearer its links to its target demographic) is, the more fluid and transparent the relationships resulting from it will be.

5. DIALOGUE AND RELEVANCE

A company’s dialogue with each stakeholder group must be active and specialized, capable of identifying and fulfilling expectations. Analyzing expectations and actively seeking out collaboration helps create synergies, leading to greater efficiency.

This exercise also helps identify any possible mismatches in consumer perception versus a company’s internal performance evaluation. This snapshot of stakeholder satisfaction can make adaptation significantly easier moving forward, especially when identifying and managing present or future risks regarding individual stakeholder demographics (employment climate, talent attraction, supplier connections, investment/divestment interest, etc.). For this reason, stakeholder dialogue is inseparable from risk management.

The most important element, which must be maintained throughout this entire process, is interactions based on transparency and trust, focused on providing stakeholders with information relevant to their interests and expectations. This, in turn, fosters relationships focused on value creation and improves the organization’s capacity for further development focused on markets, employees, products or whatever else may be required.

6. PLANS OF ACTION AND ACCOUNTABILITY

This stage is focused on collecting information from multiple relationships of varying closeness across different channels, identifying risks and evaluating stakeholder satisfaction. If we want to make appropriate use of all this information, it is imperative we develop a plan of action. This plan must have clear, focused objectives that emphasize the maintenance of relationships with each demographic while also remaining aligned with the greater strategic plan. This is a daunting task, so to aid in this process, a reliable measurement system should be implemented to provide accurate, contrastable information regarding the evolution of each demographic.

This requires company executives to draw on their in-depth understandings of their business and its international benchmarks to create a set of monitoring indicators for evaluation by multidisciplinary parties. Initial measurements allow for informed decision making, improving a company’s ability to form plans of action for the short, medium and long terms.

As we have discussed, stakeholder and capital management, along with accountability for those in such positions, has shifted from being a relatively impactful obligation to an essential mechanism for building relationships with stakeholders. Engaging in this activity allows companies to actively bolster their knowledge pools while constantly updating their strategies, emphasizing sustainable value creation for the future.

MANAGE TODAY TO WIN THE FUTURE

Organizations must be capable of creating and executing on sustainable value propositions for their stakeholders. This should focus on clients first and foremost, but also recognize their duty to understand and maintain their operational ecosystem.

Short-term value creation and results-oriented management are essential for any organization, but these are no longer enough. Companies must take into account any circumstances affecting their ecosystems, incorporating all forms of capital into a proposition for shared value creation.

Currently, organizations must address two challenges in parallel: Efficient management today (a short-term vision to avoid smaller stumbling blocks) and effective change management (a long-term vision to guide the organization’s journey). Successfully managing both these challenges in equilibrium will help prepare companies to face an unpredictable tomorrow.

Corporations must also develop a new leadership style, one focused on company purpose and engaging the groups that allow the enterprise to function. In this, authority and cooperation hold greater sway than organizational command structure.

Implementing frameworks for creativity, research and innovation is essential for increasing value. Organizations that welcome disruption with open arms will find themselves in an advantageous position moving forward. In doing so, companies will become more agile, effective and efficient in their responses to opportunities and threats within their ecosystems.

Every company must understand that it has not evolved in isolation, but rather is always immersed in an ecosystem, one whose maintenance and growth are intimately connected with its own. Moving forward, the best arrangement companies can create for themselves and their business worlds is a culture of cooperation among the various members of their ecosystem, changing the operational paradigm to create win-win scenarios for all involved.

There are changes on the horizon, and they are numerous and far-reaching. If a company wishes to respond adequately, the only option is to emphasize change management in internal operations. Boards of directors and management committees must devote sufficient time and resources to this new necessity.

As organizations, it is our duty to be the instigators of change. We seize the reins of society and ready ourselves to conscientiously act within a constantly evolving ecosystem. This is the only way we can win the future

“Short-term value creation and results-oriented management are essential for any organization, but these are no longer enough. Companies must take into account any circumstances affecting their ecosystems, incorporating all forms of capital into a proposition for shared value creation.”

This analysis was written with the collaboration of Aída Cerón, LLYC consultant in Madrid.