Corporate strategies for private capital incursions M&A and share activism in the post-Covid 19 era and a beleaguered stock market

In the current environment of plummeting stock prices due to the coronavirus crisis, and great uncertainty over how the global economy will recover, it is fair to expect an increase in conflictive situations in M&A operations. This poses new challenges for boards and management teams, as companies are now more vulnerable to potential attacks than under normal market conditions. In this regard, the role of private equity and activist funds becomes particularly significant, given their high levels of liquidity. The market is already anticipating increased activity from private equity and activist funds, which can have an impact on any listed company, regardless of its size. Facing this new reality, where capital needs will be paramount, companies must prepare themselves on several fronts, and with significant changes in attitude. Anticipation, better communication with investors and greater transparency must prevail in this context, as well as a comprehensive communication strategy.

An unprecedented shock to the economy

The Ibex 35 lost more than 30% of its value from February 15 to April 20 as a result of uncertainty and volatility generated by the Covid-19 health crisis. The Continuous Market has not done much better: among medium and small caps the drop has been over 25%. Some measures have slowed the collapse, but we are far from seeing a stabilization. The situation is particularly serious in the case of companies in sectors directly impacted by the pandemic, such as tourism. If someone had wanted to take a controlling stake in IAG on April 20, for example, they could have had half of the company for just over £2 billion, almost a third of what they would have had to pay at the end of 2019.

With world markets witnessing unprecedented falls in valuation in recent weeks, there is still no real idea of where and when calm will return. A combination of the abrupt end to a bull market that many felt was due for correction, together with the overwhelming concern and uncertainty brought about by the global Covid-19 pandemic, has resulted in the most turbulent market conditions since the 1930s.

This means that many Spanish companies are trading at ‘bargain prices’ and control of their capital could be under threat. This prompted the Spanish government to take action and place limits on investors seeking to take advantage of plunging valuations. Accordingly, the same Royal Decree that declared the state of alarm also banned acquisitions from outside the European Union if, as a result, stakes equal to or greater than 10% were declared in national listed companies. Initially, the Royal Decree established that this measure affected only certain strategic sectors. However, imprecision and numerous exceptions and assumptions in the text led to a de facto paralysis of corporate operations, however unimportant the activity of the companies involved.

But this measure is in principle temporary and, while potentially extendable, must at some point be terminated. It is therefore likely that these exceptional and temporary measures to protect the economy and strategic companies will be annulled some time after the state of alarm is lifted to restore normal functioning of markets and competition as soon as possible. This should coincide with an end to limits on short selling that will help a return to normal functioning of the financial markets. At this point, without protectionist or interventionist measures from the State, companies will have to face the new reality. In this period of uncertainty over the timing of the exit from the health crisis, the longer it lasts, the more risk aversion will increase and the more serious the consequences for business investment will be.

In this context, where the survival of some sectors is going to be at risk, very few companies will be able to dream of corporate operations, even if organic growth is difficult. At the same time, the recession resulting from the pandemic has put the credit sector in quarantine. It will not be easy for banks, concerned with safeguarding their capital, to lend money for transactions with minimal risk. Therefore, operations of an industrial nature appear to be highly unlikely. While it will not be easy, it should nevertheless be possible for listed companies that need to strengthen their equity base or diversify their financing to do so through the financial markets, either through capital increases or debt issues. In this difficult environment, a number of scenarios are more than likely:

- M&A activity and activist campaigns could increase, replicating what occurred after the global financial crisis in 2008.

- Mergers and acquisitions as well as activism may be driven by cases of opportunism, survival needs, cheap debt and high levels of liquidity in the hands of private capital. In 2008 and 2009, in the aftermath of the financial crisis, there was an increase in unsolicited or hostile transactions. Already, potential deals are being announced, such as the one reported by the Wall Street Journal on April 21, which said that “Expedia is in advanced talks to sell an interest to private equity firms Silver Lake and Apollo Global Management Inc. after travel bans caused by the coronavirus pandemic destroyed the online booking company’s business”.

- The number and volume of transactions may increase once market conditions begin to stabilize.

The number and volume of transactions may increase once market conditions begin to stabilize. ”

Private equity capital is emerging as the great enabler of M&A

The impact of the crisis on stock prices and the need of many firms for capital injections will bring attractive opportunities that some players will want to exploit. Of course, the last few months have given a very clear indication of who the main candidates could be. According to Mergermarket, private equity firms accounted for one third of global M&A transactions in 2019 equivalent to 501.95 billion euros. The liquidity accumulated by private equity in recent months, is likely to continue growing for this type of player.

Along these lines, financial data and software company PitchBook and independent investment and financial services bank Canaccord Genuity, through its Quest analysis platform, recently said the current health crisis and resulting economic recession may lead to an increase in private equity transactions in listed companies (PIPE- Private Investment in Public Equity). Analysts concluded that these operations (which usually involve firms selling shares or convertible securities at a discount) are more likely to occur when “companies seek liquidity at times when credit is difficult to obtain“.

Some of these large private equity firms have already openly stated their intentions. This is the case with Advent International, whose president, David Mussafer, recently told the Financial Times that “there is now an opportunity for us to get involved with some of the most incredible businesses on the planet that heretofore might not have been interested, or needed capital, or sought a partner.” According to some experts, the target would be companies that had very high valuations before the pandemic and the so-called “carve-out deals” (sale of specific business units by large corporations).

Even so, these scenarios must coexist in the short term with the needs of their existing shareholdings. In fact, many of these funds are being forced to provide additional liquidity or even buy back debt from firms in their portfolios. This situation can lead to a hiatus in disinvestments due to the difficulty of obtaining satisfactory returns. Some of these firms, which need to put into operation the amounts of capital they have raised in recent times, are warning their shareholders of expected income declines this year due to the impact of Covid-19 on their businesses and the consequent downward valuation of their portfolio.

On the other hand, it is important to take into account the increasingly active role that sovereign wealth funds can also play. On 16 April, the Financial Times warned that these were moving to buy assets whose prices were falling sharply, seeking above all to invest in sectors with rapid recovery potential, such as healthcare or technology and logistics. Among the potentially most active players, the FT pointed to the Public Investment Fund of Saudi Arabia (PIF), Mubadala, the Qatar Investment Authority and the Abu Dhabi Investment Authority (Adia).

“According to Mergermarket, private equity firms accounted for one third of global M&A transactions in 2019 ”

The increasingly thin line between private equity and activist funds

Historically, the relationship between venture capital funds and activist funds has been characterized not so much by collaboration as by confrontation. Activist investors, who had minority stakes in listed companies, often opposed acquisitions by private equity firms, thereby putting upward pressure on the final price. Meanwhile, private equity benefited from activist funds by acquiring the unprofitable divisions that the latter’s activity led to their sale.

Today, however, the boundaries between the two players are disappearing. Increasingly, activist funds are employing the tactics of venture capital and these are developing activist campaigns in the companies where they invest. The main reason is that they often target the same companies.

Also, the skills of each investor group are closely aligned and similar: a clear talent for identifying undervalued companies and the technical know-how to restructure and manage them properly and drive value creation.

It is true that often the changes required take a relatively long time to materialise and generate a profit, so it is not uncommon to see investments with retention periods of up to three years. A period, which in the case of activist funds, can be even longer, with a correspondingly low portfolio turnover, as opposed to the shorter terms of hedge funds.

It should not be forgotten that many activist funds have been as affected by the recent falls as the rest of the market. Some have been forced to withdraw from previously planned campaigns and to reward investors from their own resources, while others have reached agreements with their target companies. It is also true to say that n cases of mergers and acquisitions, valuing a transaction has become much more difficult.

Nonetheless, both classes of funds have easy access to liquidity. Taking advantage of the recent downturn in the markets, they have the capacity to build significant positions in selected companies and, at some undetermined point, use that previously acquired leverage to bring about changes in business strategy.

Once the recent turbulence subsides, investors will have a clearer idea of which companies are underperforming and opportunities will emerge for experienced private equity firms to make a credible case for change. In its latest quarterly report on shareholder activism, investment bank Lazard notes that the pandemic will create a new class of activist targets, for example companies with complex or vulnerable supply chains. In the same report, Lazard predicts that “activity levels will increase as the overall economy normalizes and the M&A market returns as a viable avenue for value creation.”

“Increasingly, activist funds are employing the tactics of venture capital and these are developing activist campaigns in the companies where they invest. ”

Activism: a growing challenge for any listed company

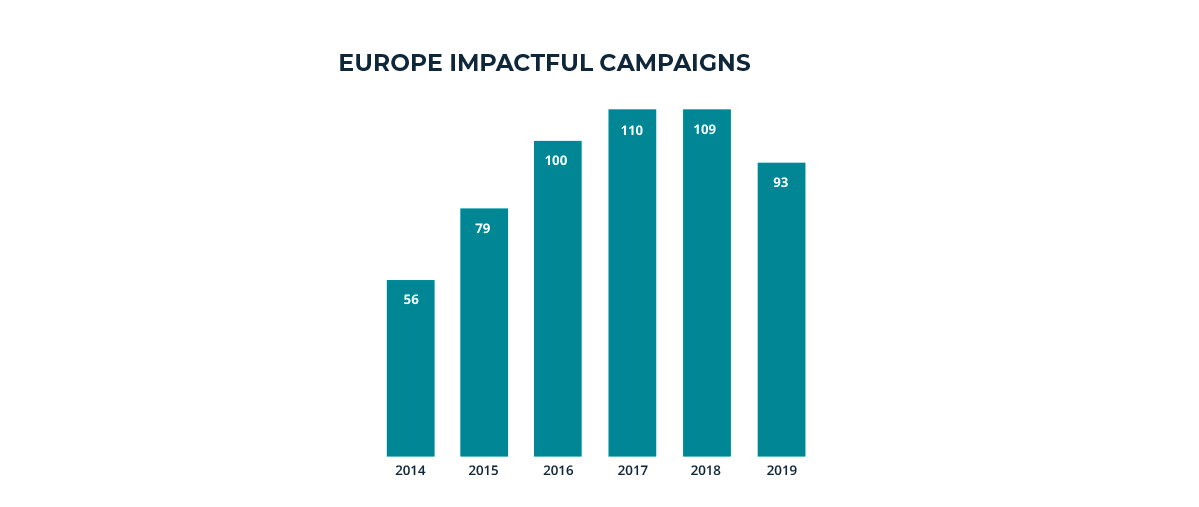

Shareholder activism is a trend that originated in the United States and began to gather momentum in Europe about five years ago. According to data from international platform Activist Insight, while 2014 closed with only 56 campaigns launched to influence changes in the management of companies in Europe, in 2016, 2017 and 2018 there were always more than a hundred. In 2019 they fell to 93, perhaps due to revaluation of the main European indices, although the trend shows that this activity is now consolidated as a reality that companies must learn to manage.

In fact, the market is beginning to assume that the collapse of the stock markets will make this type of investor even more active. This can be deduced from a survey of investors carried out by BCG last March, where 59% of those surveyed said the Covid-19 crisis would lead to an increase in activist campaigns.

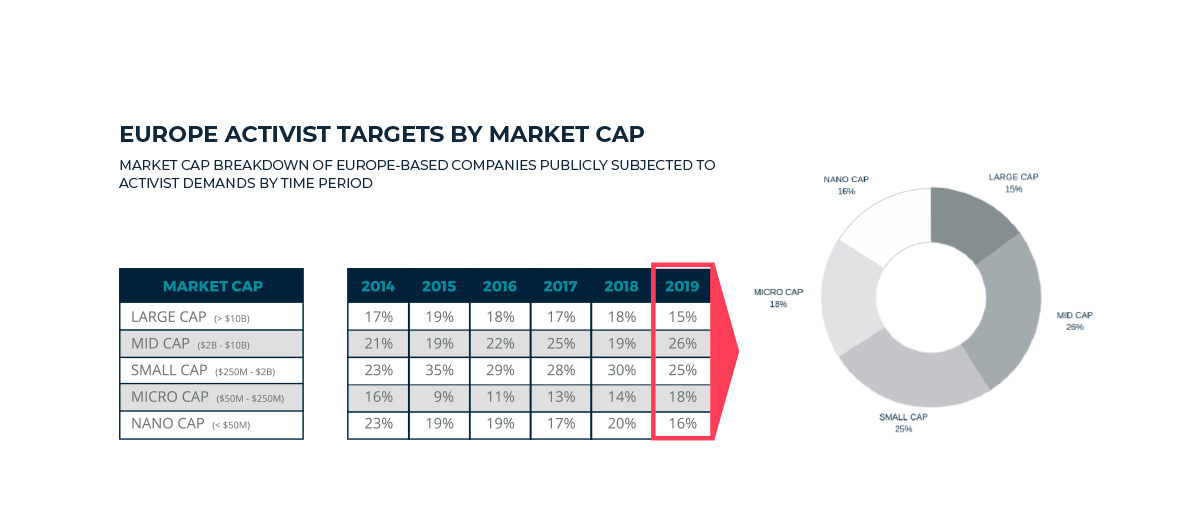

In this sense, it is important to note that this reality affects any listed company. It is crucial to point this out, since news of an activist fund taking stakes in large listed companies has created the false perception of a threat that only hangs over so-called large caps. Current data actually show that mid-caps are the preferred target companies for activists (26%). Immediately following are companies with a capitalization of less than 250 million euros (small cap), representing 25% of the firms that have had to face demands for specific changes in their management model or strategy. In fact, those with the highest stock market value (large cap) are the least common option.

How should companies prepare for possible activist campaigns or M&A operations by private capital, which are also hostile? Can activism even be turned into an opportunity?

Companies should anticipate and be prepared to face an unsolicited, even hostile, offer from a private equity fund or group of funds, or to push back against an activist that makes unrealistic proposals. An activist fund that has gone through a difficult period may be looking for a big win to satisfy its own restless investor base. Companies facing this pressure must be able to articulate their long-term vision for creating sustainable value for their shareholders and other stakeholders and define why that strategy will ultimately generate greater value. Given this scenario, key factors will be:

- Know your shareholders/owners. Having a clear understanding of the different investment and governance perspectives of your changing capital structure is imperative in order to design an effective communication strategy. Even the largest corporations have experienced major changes in their shareholder base as a result of recent market volatility. It is more important than ever to closely monitor all buy/sell activities. Which are the most reluctant groups, which are those who have shown interest in the company in recent months, which are the most active in the sector, or what would be the profiles of those that could take decisions in determined scenarios, and how each of them might vote on specific decisions. Only by knowing these issues in advance will you be able to identify the best way to deal with their criticism.

- Know your company well. Boards of directors must be able to express to investors the long-term sustainable vision of the company they supervise. The board and management must provide an honest and objective sense of how the company lives up to this vision in comparison to its peers. This ongoing self-assessment should be done as if looking at the company through the eyes of an aggressive activist. Companies should conduct this type of analysis proactively, so that they are not forced to prepare for a valuation debate as a reaction to an offer from a third party.

- Prepare and coordinate your team. Having a team of external advisors with in-depth knowledge of your company will help you in this continuous process of engagement and evaluation. Experience, both in times of peace and conflict, is essential. Trust in them will be key to being able to respond effectively to any external demand.

- Reinforce commitment to your longer-term shareholders and engage with them. Continued commitment and engagement with shareholders is always a sound and effective strategy, but it is especially so in times of uncertainty. A lack of visibility and communication about the company’s long-term prospects increases the risk that some shareholders will be attracted by offers above the current share price, even if the offer is significantly lower than the company’s intrinsic value.

- Use communication to impact the market. The market’s assessment of a company depends on how it is perceived by many stakeholders. Regulators, analysts and the media are third parties on whose opinion the market value of your company may depend. Therefore, do not wait to receive a call in the middle of a crisis to realize who follows your activity. Choosing a low public profile cannot be an excuse for inactivity. It is vital to identify your stakeholders and establish a close relationship with them. Giving them access to senior management, keeping them abreast of your principal milestones and providing them with background information is the best way to ensure they understand your business and that they become your allies in the face of an unwanted corporate movement.

- Have a plan of action. Although the ideal is to avoid an attack (proxy fight or campaign), this is not always possible. To face this with any chance of success, it is essential to be ready to act quickly and have an organization that is prepared to do so. It will then be key to have an action plan and a previously defined procedure. Improvisation will multiply the chances of failure, and must be avoided.

“Companies facing this pressure must be able to articulate their long-term vision for creating sustainable value for their shareholders ”

How should private capital approach investing in a company?

It should be noted that private equity firms considering acquisitions in the current environment are likely to attract much more attention, as investors and analysts will analyze transactions more closely. While explaining the rationale, premium and the acquisition process for transactions are key elements in normal circumstances, those taking place during periods of market disruption and volatility require much more attention to communication strategy, as well as a proactive dialogue with shareholders (probably supported by proxy soliciting).

- Study your target well. It is common for international funds to base their entire communication strategy on investment rationale. Local sensitivities, management team profile or historical specificities of the target company are elements that are usually left in the background but become crucially important when implementing an operation. Detailed analysis of the company in which you want to invest and a strategy based on its particular characteristics are therefore key. It is also essential to analyse the environment of the target company and focus on relations with other often decisive stakeholders (regulators, public administrations, local media, workers’ unions, suppliers, etc.).

- Build your corporate narrative. In a context of market contraction and lack of liquidity, private equity funds can be an opportunity to safeguard the continuity of many companies. However, in most cases and more so in times of uncertainty and certain weakness, their image remains that of aggressive firms seeking to asset strip companies and divest in short order. To counteract this prejudice, still held by some stakeholders, it is essential to build an attractive and convincing narrative that positions private capital as a key partner in facilitating the growth of the companies in its portfolio. In the current environment, investors are increasingly demanding a coherent and convincing strategic justification for an acquisition that goes beyond the depressed valuation of a target.

- Sell” your investment model. Explain your project and make sure those that influence and take decisions (shareholders and other stakeholders) know your narrative. Investors are not too keen on surprises in M&A transactions. Private equity firms should be explicit about their investment model and philosophy before a significant acquisition is announced or leaked. Going from being seen as a predator fund to being perceived as a long-term partner can be a turning point that ensures the success of a corporate operation. This will require designing and executing a relationship plan with the target company’s key stakeholders and establishing a relationship of trust with them.

“Those taking place during periods of market disruption and volatility require much more attention to communication strategy, as well as a proactive dialogue with shareholders (probably supported by proxy soliciting). ”

Study by Finsbury, Hering Schuppener and GPG on the perspective of stakeholders in M&A operations

This recent report* on the influence of stakeholders in M&A operations, examines the new challenges a company faces when designing a communication strategy to deal with movements of private equity funds. The report notes that activist funds represent 64% of the negative comments detected among investors surveyed by the agency. It adds that with the Covid 19 crisis and ensuing difficulties faced by companies, increased opposition from shareholders to how these companies are run can be anticipated. It highlights four aspects, among others, that companies must take into account in order to build a convincing and effective narrative:

- Social networks: They occupy more and more space in the conversation, used in particular by non-financial contributors (73%) and only 14% by stakeholders of the target company and 13% by representatives of the acquirer. They are not mere amplifiers of what traditional media publish, they represent a different profile with different actors. Companies should take this trend into account in their communication strategies.

- Differentiating factors: A uniform communication strategy is less and less useful. The audiences that companies must reach represent different geographical, employment, economic and corporate governance interests, all of which directly conditions communication and requires a differential approach.

- Sustainability: At present, it has a limited influence on strategies, but growing demands in terms of regulation and allocation of investments in investor portfolios make it increasingly an essential element in corporate strategies in the face of activism.

- Engagement with employees: According to the Finsbury study, the impact of certain business decisions on employees represents the largest proportion of negative feedback in the case of M&A operations. Companies facing a corporate operation depend on their people more than they realize as the key to success. Hence the importance of a well-designed internal communication strategy.

The report was written before the arrival of the pandemic, but the agency affirms that the conclusions are still valid. LLYC is an Associate Partner in Global Partnership with Hering Schuppener Consulting, Finsbury and Glover Park Group. The combination of these leaders in each of their markets creates one of the few global platforms that advises clients in all areas of communications and public affairs, with more than 1,000 consultants in over 30 offices worldwide.

Authors

Luis Guerricagoitia