The popularity of discount stores is nothing new in European markets, but in Latin America, the new discount store phenomenon has revolutionized shopping, challenging traditional consumer channels.

In Colombia, for example, eight in ten households shop primarily at discount stores. But in a world with increasingly mindful consumers who seek to connect with brands sharing their values, how can a purely transactional model sustain itself? The discount store business model is undeniably popular in Latin American markets. This phenomenon poses questions about the future of consumer-brand dynamics—questions well worth consideration.

The Origin of Discount Stores

Traditionally, discount stores are retail establishments that sell own-brand products at low prices. This model originated in Germany with stores like Aldi and Lidl, developing into a major global boom in the 1990’s and early 2000’s. This rapid expansion created new global retail dynamics, which have reached Latin America in the last decade.

Aside from economic and financial considerations, Latin America is seeing an especially telling paradigm shift in consumption habits and consumer preferences, one that is, in many cases, challenging fundamental ideas regarding the consumer-brand relationship.

Transformation of Consumer Habits

According to Nielsen Homescan’s 2018 report on Colombian self-service spending, this model, including in traditional stores, discount stores, cash & carry and independent chain stores, was responsible for 47 percent of Colombian household spending.

The original hard discount model came about as a response to the economic crisis in Europe, but in countries like Colombia and Mexico today, it has become an effective alternative for many consumers, who find these models meet their shopping needs. In fact, there is such diversity among discount store consumers that variations within the model have emerged. Today, not only are there hard discount models, but also hybrids: Stores that exist at a crossroads between traditional retail models and these new models of efficiency.

“The concept of traditional brand loyalty no longer applies“

But how is it that a model attains such positive results across so many sectors with little or no investment in brand development or positioning? As a result of wider access to information and the “Amazon phenomenon,” consumers now want to operate independently from retail models. They wish to access a different kind of supply, one emphasizing purchase functionality, ease of purchasing and integrity of development, with a close eye on quality and value. The discount store model’s arrival to Latin American markets has only bolstered this paradigm change, making own-brands the current stars of retail.

Future Challenges for Own-brand Engagement

Own-brands are not a new factor in consumer dynamics. Large retail outlets have long maintained basic own-brand products in their portfolios, playing a strictly functional role for consumers.

According to Spanish newspaper ABC , Spain spends the second-most on own-label brands in the European Union. According to data from May 2019, 42 percent of bulk purchases in Spain are of own-brand products. This phenomenon has encouraged large brands worldwide to develop an own-brand area to strengthen organic business growth. Two major examples of this trend are Walmart and Target, whose own-brand numbers spiked in 2017 and continue to increase each year. This area may enjoy sustained growth in North America and Europe, but there undoubtedly remains a great opportunity for Latin American own-brands to participate and bolster their continued growth. Octavio Blasio believes Latin America is in an early stage of own-brand development, but will soon undergo the same natural evolution other world markets have seen.

However, the number of consumers willing to try new brands continues to grow, especially in the Colombian market. The concept of traditional brand loyalty no longer applies. Nielsen’s 2019 Global Loyalty-Sentiment Study shows that 92 percent of consumers lack brand loyalty, and in countries like Colombia, only 7 percent consider themselves loyal to their favorite brands.

The Illusion of Amazon’s Own-brands: A Lesson for the Market

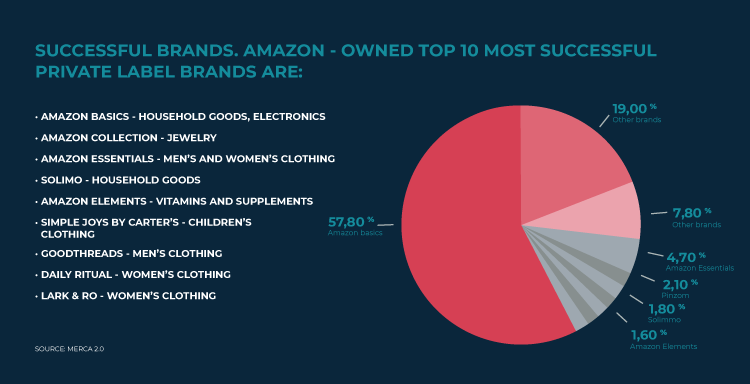

It is necessary to build a transparent, active relationship infrastructure to help you form ever-stronger bonds with consumers. Amazon has over 400 own-brands. However, a Marketplace Pulse study shows that just 10 of these own-brands account for 81 percent of the company’s own-brand sales.

One reason for this “failure” is the technology giant’s apparent branding and positioning strategy. Thus, we are presented with the challenge of not only making major investments in publicity and marketing (which have a direct impact on a discount model’s effectiveness), but also creating two-way mechanisms to transcend perceptions of having a solely functional purpose. Achieving this balance is key to creating products and services that satisfy consumer interests.

Authors

Alejandra Aljure