In a global context of protectionism, Sovereign Wealth Funds and other institutional investors (“SWFs”) continue to play a crucial role in cross-border investments. With over $ 12 trillion of assets under management, they continue to be one of the largest group of asset owners and one of the most active buyers of fixed income, public equities and alternative assets around the world.

FDI in Latin America

Foreign Direct Investment (FDI) contracted globally in 2018. In Latin America, the flows decreased by 6 % to $ 147 billion, as the economic recovery stalled. The tightening was fell most in Brazil and Colombia; while flows remained stable in the rest of the region. The industries of interests continue to be natural resources (including mining), infrastructure and consumer goods, especially those related to IT.

However, the region is still vulnerable to external factors, including monetary policy in the US and its tensions with China and other partners. Tariffs imposed in new industries such as automotive can mean higher price of commodities like copper, which is one of the main exports of the region.

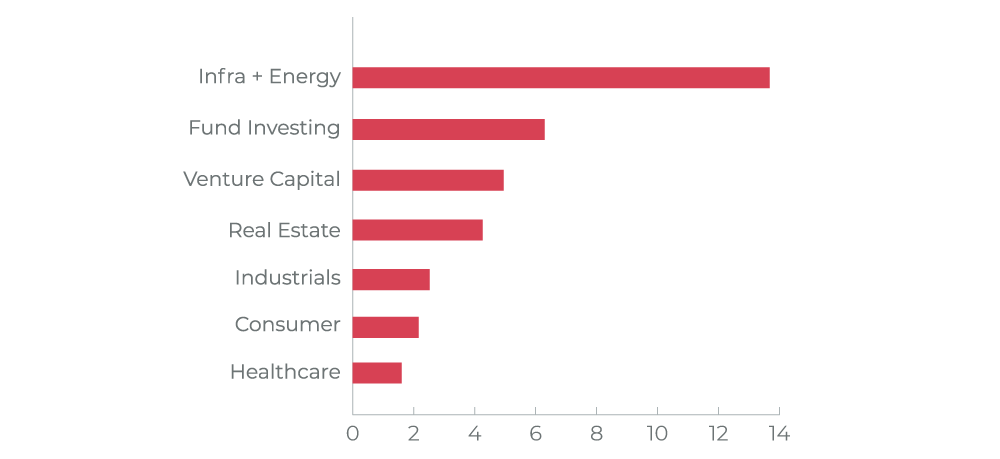

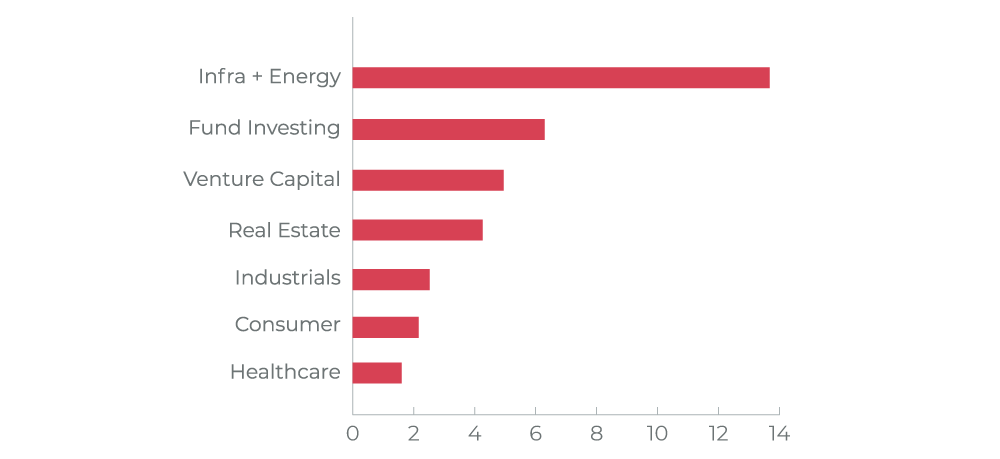

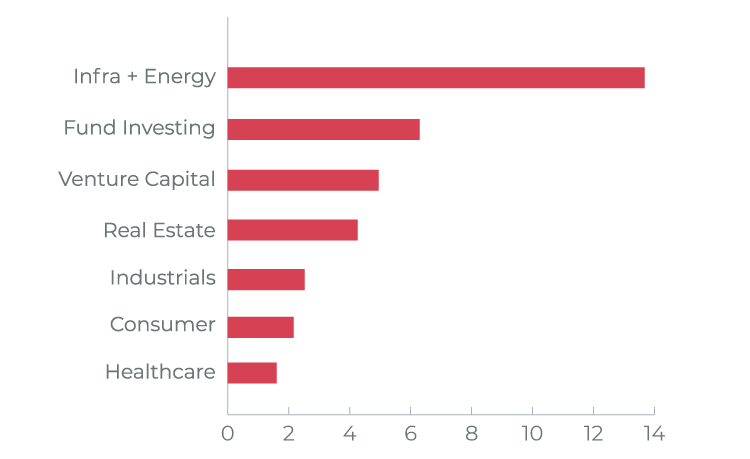

SWF investments

At the beginning of 2005, three SWFs first signaled the interest in the region: Abu Dhabi’s ADIA and Kuwait’s KIA committed to Conduit Capital Fund, with a focus on power generation across the continent, and Singapore’s GIC invested $ 200 million in a JV with AMP to acquire distribution facilities in Mexico. Since then, Sovereign vehicles from around the world have poured $ 36 billion in the region, including infrastructure and energy assets, real estate and fund investments.

As funds mature and the search for yield becomes fierce, other countries are starting to gain attention, too. Peru, Colombia, Ecuador, Argentina, Uruguay and Panama are attracting institutional capital. However, funds need to stay cautious as regional challenges remain. When Qatari Diar invested $75 million in Gran Paraiso Hotel in Cuba in 2008, the development was supposed to take 3 years. Eleven years later, the completion of the property is an unknown.

The way forward: Co-investments and Governance

One way to increase investors’ confidence in the region is by facilitating agreements with domestic SWFs. Today there are seven funds, managing over $ 35 billion that can source opportunities and offer co-investments in Bolivia, Brazil, Chile, Colombia, Mexico, Panama and Peru. This is an increasingly favored route as it minimizes fees paid to asset managers and private equity funds.

However, it also increases the exposure to Governance, Risk and Compliance, and the scrutiny from both stakeholders and the public opinion. In this context, trust is crucial, and a proper due diligence has become a key step in the investment process. Whether it is to commit capital to a fund, or to buy a direct stake into an asset, SWFs need to carry out a reputational assessment of possible risks attached to a business partner, including compliance and corporate governance.

Authors

Alejandro Romero