-

TrendsEuropean AffairsEconomyReputationSustainability / ESG

-

SectorInvesting and Financial Services

-

CountriesSpainGlobal

Bailouts, preferred stock, mortgage expenses, millionaire retirements, commissions… In recent years, days when the economics section of a newspaper contains none of these words have become few and far between. This situation has only been exacerbated by the public’s lack of differentiation between the guilty and guiltless, as well as the absence of a voice highlighting banks’ value despite their missteps. The media noise, deserved or not, is now reflected in reality, resulting in a bad reputation for an entire sector.

Reputation Analysis

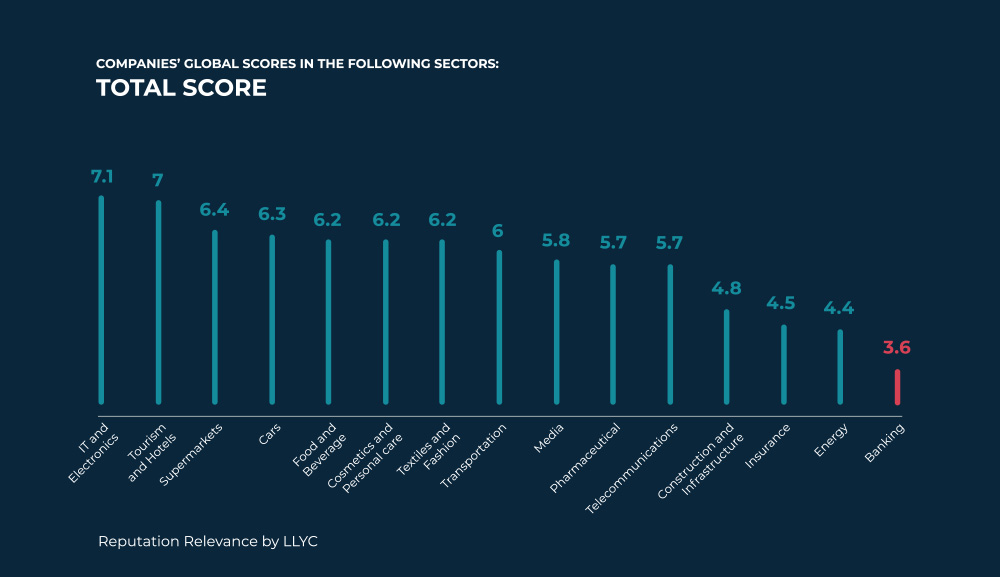

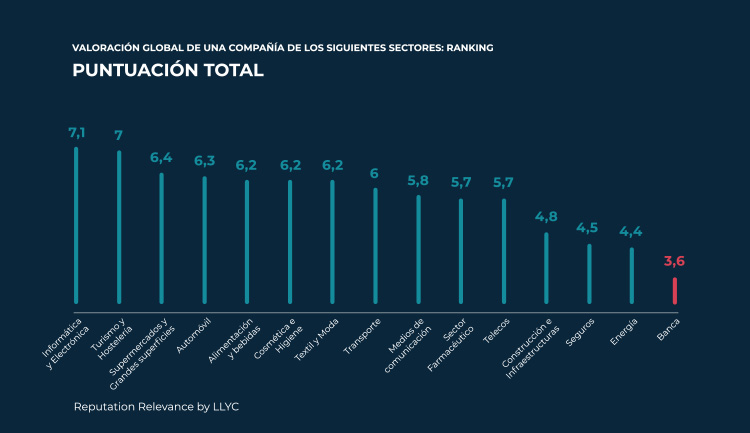

To determine whether banking’s bad press is being acknowledged and absorbed by the public, one can look to the latest Reputation Relevance study, published by LLYC. It regularly analyzes a representative sample of the Spanish population and its opinion on the country’s 15 main activity sectors, providing a global snapshot each of their public reputations.

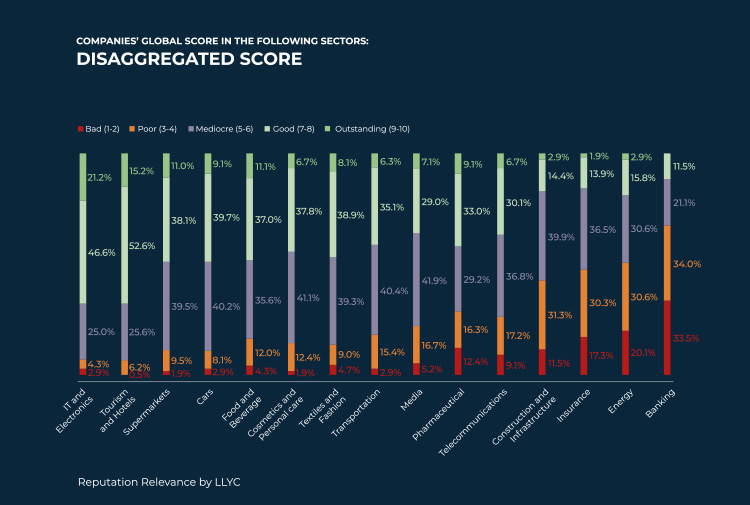

Banking is clearly the sector with the lowest score, and the only sector whose score is below 4 (3.6). Using the scoring table as a metric, the sector as a whole has a “poor” reputation, sitting only one step above the lowest possible score (“bad,” between 1 and 2).

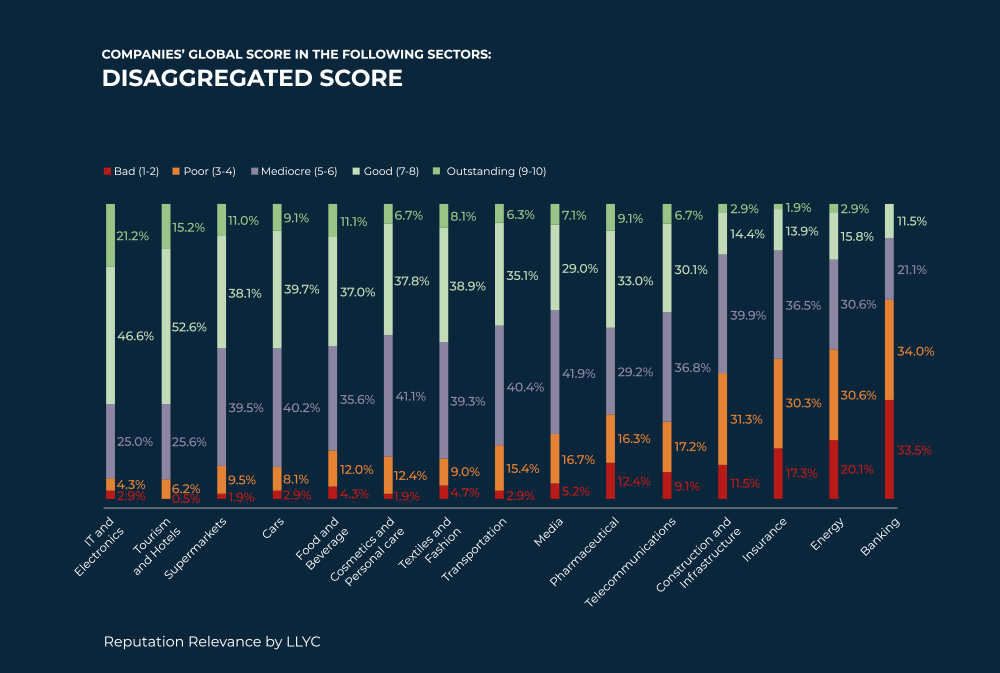

This data is even more noteworthy if we disaggregate the scores. The banking sector received no “outstanding” responses (9-10), making it the only sector with this distinction. Furthermore, the banking sector received the highest percentage of “bad” and “poor” scores, with more than 67% of responses in these zones.

How did the current situation come about?

Intense Personalism

Banks began to protect themselves by instituting presidential structures with relatively little regard for the interests of shareholders during this period. Since then, banks have tended to appear as insular communities, distanced from public realities.

Lack of Social Sensitivity

As regional and national politicians assumed control of certain savings banks, the sector began to grow exponentially. Some politicians climbed by questionable means. When problems began to arise as a result, their miscalculations or dubious transactions became public knowledge. These stains extended to the whole sector, causing the banking sector’s first systemic reputational crisis. Furthermore, many banks attempted to downplay that crisis rather than own up to it.

Loss of Customer Confidence

Until relatively recently, most generations of Spanish citizens had a near-blind faith in bank directors. But this relationship came from a time of traditionally uncomplicated business activity, usually limited to offering standard products and mortgage advising. This trust was shattered by the issue of preferred stock. While most invested customer money was eventually returned, a considerable portion had to be recovered by heirs. Many elderly customers died without ever seeing their money, and bank reactions to this situation were not proportionate to its severity.

Silence Instead of Communication

By some interpretations, the main mistake banks made was failing to spread positive messages just after the Bankia bailout. Instead, most entities preferred to remain silent, and were thus unable to react to the regulatory changes to the minimum interest rate clause (cláusulas suelo) or fluctuations in the tax on documented legal acts.

Scarce Legislative and Judicial Interest

Many believe the recent legal confusion involving banks could have been mitigated had there been some legislative anticipation.

Focus of Political Attack

Most agree that in recent years, every political party has joined the crusade against banks. Attacking banks has become a common way to gain support, one often used to divert media focus from political responsibilities.

Possibilities for the Future

The journalists interviewed helped outline some possible courses of action to improve the banking sector’s reputation, putting forth eight points emphasizing the importance of the financial system and its key role in society:

Social Empathy as a Priority

In order to overcome disillusionment, banks should make empathy the backbone of their communication strategies. People neither trust nor like the popular image of the haughty, aggressive banker; now, they demand a warmer, friendlier demeanor. Financial entities should promote simple, modern and direct methods to present themselves as relatable to society. Bank president and CEO rhetoric has been moving in this direction for several years, but some still believe that simple, sincere and human gestures are still missing, including apologizing and accepting responsibility where necessary.

Steps Towards Transparency

You can never have enough transparency. This is the journalists’ number one demand. Banks should make an effort to proactively share new information with their customers to create a more equitable relationship. Simply complying with stock exchange and regulatory requirements is now insufficient.

Agility: Credibility Instead of Silence

Financial entities must stop hiding and going against the current. In many instances, lack of agility has caused the sector to miss opportunities to highlight its value and reclaim its positive social role. Until very recently, banks have opted to focus on service quality, overlooking chances to support universities or integrate into society at large. Almost all the journalists recommend investigating these ideas in more depth.

Financial Education

The flipside of multiple generations of unconditional trust in banks is a weak financial education in the general public, which has historically characterized the country. The vast majority of journalists interviewed agree that financial education should be incorporated into schools. They recommend teaching finance as a standard subject, something they believe would be extremely helpful in establishing an equitable relationship between banks and their customers. Moreover, financial entities should visibly be this initiative’s main backers.

The Power of Simple Language

Many journalists interviewed believe that the excessive complexity of contracts has contributed to rulings against banks, especially in cases regarding minimum interest rate clauses. The court of Luxembourg called into question whether customers were able to clearly understand the documents they had signed. The solution is simple: use clear and easily understandable language, either in contracts themselves or in an indexed document.

Comprehensive Analysis

Increased litigation, as well as the almost ubiquitous suspicion surrounding the banking sector, has prevented banks from asserting their rights, emphasizing their social value or prioritizing the security and legal predictability they require. Journalists interviewed suggest a more coordinated and informative approach regarding bank perspectives.

Unions and Corporatism

According to the journalists, many problems arose as a result of disunity among financial entities. The sector never pushes agendas as a unified front, something which could help banks improve their collective image.

Leadership in Problem Solving

Another common thread in interviews was the idea of a perspective shift. Banks must acknowledge that what is most important is not seeking absolution from any wrongdoing, but convincing the public that banks are, have been and will continue to be a fundamental part of the country’s growth and development.

Authors

Juan Carlos Burgos

Valvanera Lecha